Applovin: Are Mobile Ads Worth 100B?

Does the emerging AdTech player hold a candle to Google and Meta?

Markets are booming, Bitcoin is nearly $100,000, and interest rates are dropping by the month. In all the hype around the economy, one company that’s taken center stage is Applovin. Recently the company amassed an all-time high valuation of $100 billion. Is this just another Gamestop-esque stock or should we take a closer look behind the scenes?

Inspired by McLovin from Superbad, Applovin is likely one of the most valuable tech companies you’ve never heard of. And there’s a pretty simple explanation for why; the company was worth half of what it is today a mere one month ago. That’s right - they were irrelevant in the tech space until recently. A year ago, they were hovering at a modest $10B valuation driven by two main products: AppDiscovery and MAX.

So what changed? A surprise earnings report showed $1.2 billion in Q3 revenue and massive margin expansion with a near 36% net income margin. Financial success combined with their new e-commerce product line has seeded investor confidence in Applovin’s ability to expand its advertising service past mobile gaming and e-commerce to other niches.

Mechanics Of Mobile Advertising

Within the overarching advertising ecosystem lies a smaller ecosystem for mobile network ads. These ads could appear as videos or pop-ups between sections of a game, as display ads at the top or bottom during your app experience, or as embedded rich media while scrolling through sections of an app.

Mobile advertising may seem niche but spending is expected to surpass $400 billion in 2024. Part of AppLovin’s meteoric rise is that they’ve been able to hit extraordinary levels of profit facilitating only $10 billion in volume for a subsection of the economy, mobile gaming clients.

While in a niche subset of the ecosystem, Applovin still faces considerable competition from ad networks offered by the world's largest companies. AdMob by Google, Audience Network by Meta, and Amazon Publisher Services.

Each platform has quirks, but advertisers can use one or all to promote their brand through mobile networks. Google, Meta, and Amazon are all quite similar. Each platform can be thought of as an exchange in financial markets. A network’s essential function is to present a marketplace where advertisers compete to bid for ad space on publisher apps. Several pricing models exist such as cost-per-impression, cost-per-click, or cost-per-action, based on the conversion event that matters for the advertiser.

Real-time bidding allows dynamic adjustments in the market for ad space, saving massive headaches for app developers who may have had to create ways to accept bids and publish ad content on their apps. These advancements in the ad network space have led to a new reality: the commoditization of AdTech. Unlike financial exchanges, there is no barrier to being traded on multiple networks, and it is in the best interest of app publishers to optimize multiple ad networks. This is known as ad mediation: Applovin’s plan to win the industry.

Winning In Ads

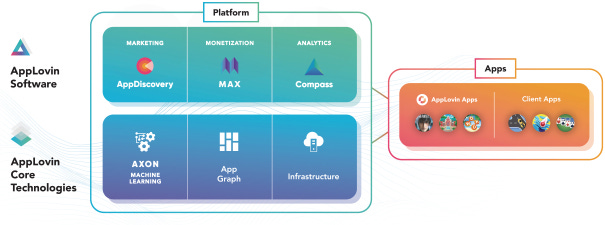

This graphic from Applovin’s IPO prospectus laid out their plan of action. First, help app developers market their apps with AppDiscovery. Adam Foroughi started AppDiscovery after failing to build awareness for app projects over the years. AppDiscovery is built on AXON, the machine-learning algorithm that aims to improve the likeliness that your app is downloaded. Hint: this is where their use of AI impacts the business's long-term prospects.

While that’s cool, it does not change the fact that Applovin competes in a playing field among the largest data aggregators. Google, Amazon, and Facebook have built trillion-dollar companies scouring user data and optimizing the ad conversion experience for companies that use their ad networks. Given that, what must Applovin do to win in this cutthroat industry?

Applovin MAX. The company’s edge comes from its ability to succeed in mediation. MAX can tap into Applovin’s native ad network, which they testify to be 5-6x greater than many other ad networks (probably except Google or Meta). If that’s not as effective for you, MAX can optimize a combination of other networks to deliver the best eCPM (effective cost per mille) to deliver the best ad for the publisher. Each ad has to deliver the greatest revenue, with the caveat that they are quality: relevant, easy to skip, and appropriate for the audience.

To drive the greatest return, you want to find the best mix of ad units, fill as much space as possible, and optimize revenue. All while growing and retaining your audience.

Ultimately, customers are partial to the platform that drives the greatest amount of money. As such, MAX works to optimize ARPDAU (Average Revenue Per Daily Active User) while AppDiscovery tackles UA (user acquisition). The two give a mobile app developer a full growth flywheel, which serves as a growth engine for an indefinite time.

Applovin - Why Mediation is Critical

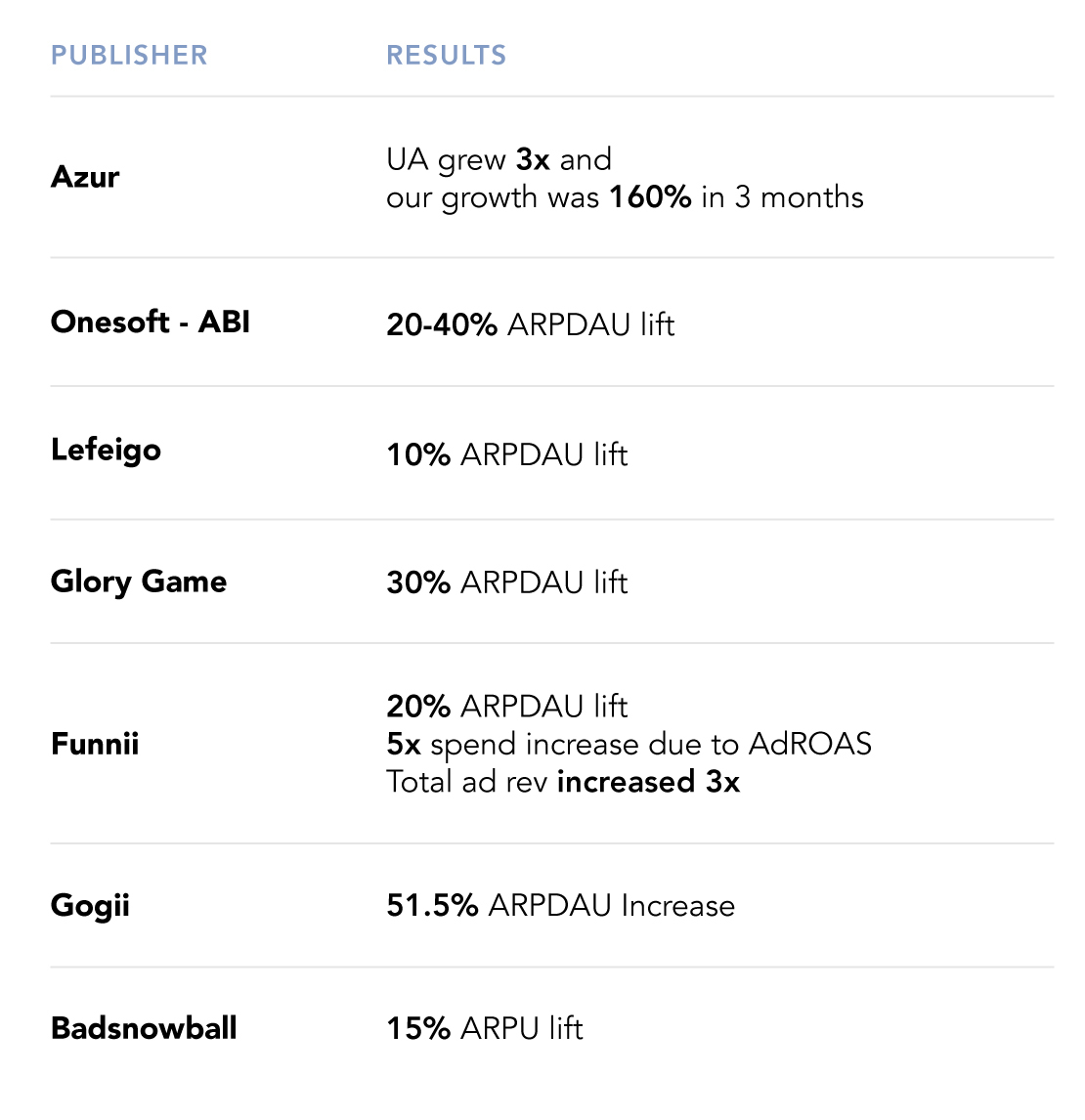

MAX has been winning since 2021, proving that mediation is not commoditized. Adam wrote a letter to the public in late 2021 explaining the importance of mediation as well as its impact on a few mobile gaming apps that utilized MAX.

That’s all for today folks! If you enjoyed this piece covering Applovin’s surprise takeover of the AdTech industry, hit the like button or drop a comment with your thoughts. Simply contact us by replying to this email if you have any insider takes or leave a comment on our Substack page!