Airbnb Is Not An AirBed&Breakfast

The battle between Airbnbs and Hotels just got juicier...

Brian Chesky and Joe Gebbia were a couple unemployed art school grads back in October of 2007 when they decided to rent a few air mattresses in their apartment for a local San Francisco conference. Soon after, they realized the value of what they had just stumbled upon.

Since then, Airbnb has experienced hockey-stick growth peaking at $134 billion in February of 2021. Today, there are over 7.7 million active listings on the platform spanning 100,000 cities worldwide. Fun fact, more than 6 guests check into a listing every single second.

However, the company has faced a slew of headwinds over the past couple years. The stock is down 13% since the end of March with most of that movement coming from their recent earnings call.

Remember all those stimulus checks from the pandemic? This influx of cash into people’s pockets combined with nothing to waste it on created the perfect storm for prospective hosts. Midway through 2023, the inventory of available homes for sale sat at 570,000 while Airbnbs touched almost 1 million. Airbnb even reported that between Q2 of 2021 to Q2 of 2022, the number of new hosts grew by more than 50%.

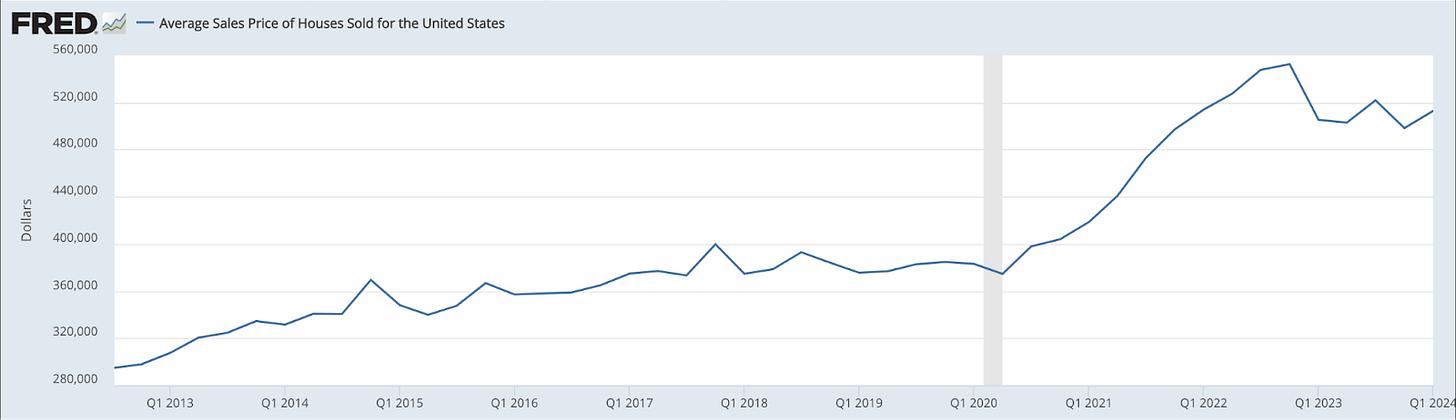

Common logic would have us believe that all this supply must have meant low prices for renters. But, this spending spree created a positive feedback loop of high inflation and increasing home prices. High inflation meant looming interest rate hikes (first graph) and massive home buying activity meant the average sales price of a home almost doubled between 2012 and 2022 (notice where it started picking up).

Hosts bought in high and got left to dry. And to make the best of it - most hosts are turning to profit maximizing methods of charging high cleaning fees, surge pricing in peak seasons, and various extra fees. It's become more of a full on business rather than simply renting out a spare bedroom. To add fuel to the first, top cities for new listings saw huge declines in rental revenue.

That’s just half of the issue. It did not take long for HOAs and municipalities to see the number of short-term rentals and decide enough was enough. New York City enacted “Local Law 18”, requiring hosts to register with the city and be present during a customer's stay. San Francisco has similar rules, enforcing hosts to live in the unit for 275 days a year and enforcing them to obtain a short-term rental license. Santa Monica, a suburb of LA, is no different in requiring hosts to live on the property during a renter's stay. This has wiped out 80% of the Airbnbs in the suburb.

Prices are high, hosts can barely make mortgage payments, and cities like LA, New York City, San Francisco, Denver, and Portland are all trying to ban short-term rentals. Let’s dive into how Airbnb is tackling this.

What Is Airbnb Doing?

Brian Chesky had a couple chances to address the future of Airbnb over the past couple of weeks during their 2024 Summer Release and the Q1 Earnings Call. And boy did he tell us quite a bit.

Well, total nights and experiences booked on the platform have increased since the same time last year to 132 million, up 9.5%. Airbnb reported revenue for the first quarter of 2024 at $2.1 billion and a profit of $264 million. That’s the most profitable Q1 ever with a record high Q1 take rate of 9.3% because of Easter weekend.

Airbnb also revealed Icons during their 2024 summer release. Icons is an experience that's “more than just a stay” - tied to something like a brand, movie, cultural movement, sports, or music. Chesky drew on a campaign Airbnb did 10 years ago where they listed an IKEA sample room on the platform which generated tons of buzz. Examples of these experiences include: the last operational Blockbuster in Oregon, the house from Pixar’s Up, and an interactive stay with Jahnvi Kapoor or Khaby Lame.

The level of detail and investment in tapping into the nostalgia with these stays are quite simply insane. And if you take a look at the prices, everything is under $100. Why go through all this pain? Chesky says it is to keep Airbnb’s brand relevant and change the way that people think about Airbnb. Cheap, quality, exclusive stays go a long way in reverting the laundry list of issues circling the brand of Airbnb.

From the looks of it, Airbnb is trying to create their own experiences for people to enjoy - adding more excitement to the platform and giving customers a potential hint at where they are headed to next - entertainment. The added flair in these Icon stays is that its not just aesthetically similar, but there’s an interactive element. For example, the house from the movie Up actually floats up and Xavier’s Academy has a built in adventure. Going even further, if you are joining Kevin Hart on a show or Feid on tour, it’s not even about the stays anymore.

I'd say it's working too. In one week, Icons has generated over 8,100 pieces of global media coverage and driven 371 million social media impressions (more press and attention than their IPO!). It’s similar to how people forget about Disney’s controversies when they walk into Magic Kingdom.

The sheer volume of social media impressions did wonders from mobile downloads. Just between Q1 2023 and Q1 2024, mobile downloads increased 60% YoY. Airbnb touted this multiple times during the call but the reality is if anyone wants to see more about a certain Icons stay, Airbnb directs them to the app. I really wonder how many of those downloads came from the release of Icons.

In the past, Airbnb was able to enjoy a take rate between users and hosts on the platform, but it seems as though they are trying to diversify revenue streams by offering an end-to-end experience that they take the revenue on.

Setting The Standard

As a platform, Airbnb’s powers cannot reach into local regulation or the real estate investing of hosts. The main issue that Airbnb is trying to solve is in the space of optimization. To get users who look for Airbnbs to actually book them. The type of vacationer that book an Airbnb more or less obvious. Groups of people that stay for a longer period of time. In fact, 50% of nights booked are of long stays of a week or more. Cleaning fees and total charges just don’t make it economical for the transient vacationer.

Well, prices are trending down. The platform has implemented features like “total price before taxes” to show the sum of all small fees before taxes when searching for a stay. Users can compare full prices of stays leading to much more upfront price transparency. So far, its been somewhat helping. Not only are many hosts reducing cleaning fees - Airbnb is setting the standard for industry.

Right now, Airbnb’s highest penetration markets are US, Canada, Australia, France, and UK. The next step is to move into markets like Mexico, Brazil, and Latin America. Longer down the line - China and India. Expanding into untapped markets means taking advantage of huge price discrepancies and unlocking huge markets (Asia itself is more than 4.5 billion). Asia is an untapped market because of many young people who are not predisposed to hotels and are on social media.

Airbnb also removed thousands of low quality listing from the platform during the quarter leading to 15% net growth in listings. This effort to maintain quality as well as offer features like “compare listing” for hosts and guest oriented tools like group lists and group chats with hosts further involve multiple people during a certain stay.

That’s all for this one folks! If you’re interested in more content around how tech companies are transforming real estate, let me know by liking this post or dropping a comment. If you enjoyed reading, please feel free to share with your friends. Reach out to us by replying to this email if you have any insider takes or leave a comment on our Substack page!